There are two types of experiences that customers have with banks.

1. Agent: Hi, this is Neha from ICICI Bank, we are offering you a free credit card

Customer: Please disconnect the call and never call me again.

2. Agent: Hi Mr. Rahul, this is Neha from ICICI Bank, you visited the branch last week regarding a bounced cheque… is that issue resolved?

Customer: Yes.

Agent: Great! This can happen in a credit crunch situation. We are offering a free credit card to extend your available credit in similar situations. Would you be interested to know more?

Customer: Sure…

The difference:

The first call comes across as spammy, the second one is contextual

The bank rep isn’t just calling to sell something

In this article we’ll discuss how to avoid the first experience from ever occurring. We’ll also share how you can ensure the second experience leads to a better relationship (and more transactions as a result) by selecting and using the right CRM (customer relationship management) software.

A banking CRM stores all interactions with current and potential customers. This helps agents deliver personalised experiences and improve their sales numbers as they can gather contextual insights from within the CRM.

Apart from its core functionalities, a CRM can be used to automate repetitive processes such as sending WhatApp reminders for the following:t

Updating KYC details

Issuance of new ATM card

Relevant personalised offers like a car or home loan

India has the highest population in the world recently surpassing China. And every adult is required to have a bank account. To top that off, people even have multiple bank accounts. And managing these many people, their accounts and loans is a tremendous task, to say the least. Here’s how banks using a CRM for banks can help you streamline your operations:

With information centrally stored in the CRM, reps can access a client’s conversation history, understand their preferences and needs before answering their query. This means:

Personalised interactions

Faster issue resolution

Happier, more loyal customers

The client calls to block their ATM card. The rep notices (on the CRM) that the customer’s credit card has also expired. So after blocking the ATM card, the rep offers to renew the card. The end result: Issue solved! Customer satisfied! Profits maximised!

CRM data also helps your reps pitch contextual upsells. If a client calls to enable international transactions — the rep can offer an international credit card, maximising value for the bank as well as the client.

Plus, a CRM in banking acts as a debt collection software and helps you settle outstanding debts by tracking them throughout the loan process.

A capable CRM system boosts your bank’s efficiency by automating routine tasks and workflows such as the following:

Sending personalised reminders for loans, EMIs, overdue bills, etc.

Sending updates about query resolution status

Marketing new loan and insurance offers to existing clients

Accomplishing tasks, resolving queries and setting up automation frees up your rep’s time so they can focus on:

High-value work like pitching upsells and relationship building

Engaging customers without compromising on the human touch

In banking, there are so many documents at so many places that it’s impossible to find the right one at the right time. CRM stores all documents in a central, secure, searchable place.

As a result:

Reps can find the right document quickly

They will never lose important documentation

Document management, thus, makes your reps better and more efficient at their jobs.

Banking involves strict regulatory compliance. A CRM helps by maintaining detailed logs of every customer interaction, document upload, and transaction update.

So when the auditors come knocking, your bank doesn’t scramble. It already has:

Less panic, more control and peace of mind for your compliance team.

A new customer signs up for a savings account. The CRM triggers an onboarding flow:

No manual hand-holding. No missed steps. Just a smooth, professional first impression right from day one.

That’s how banks turn signups into relationships.

Let’s say a customer applies for a loan at one branch but walks into another to ask about it. Without a CRM, the second branch is clueless. With a banking CRM, they have full visibility.

This anywhere-access helps banks operate like one unit, not disconnected islands. It leads to faster responses, better coordination, and more trust from customers.

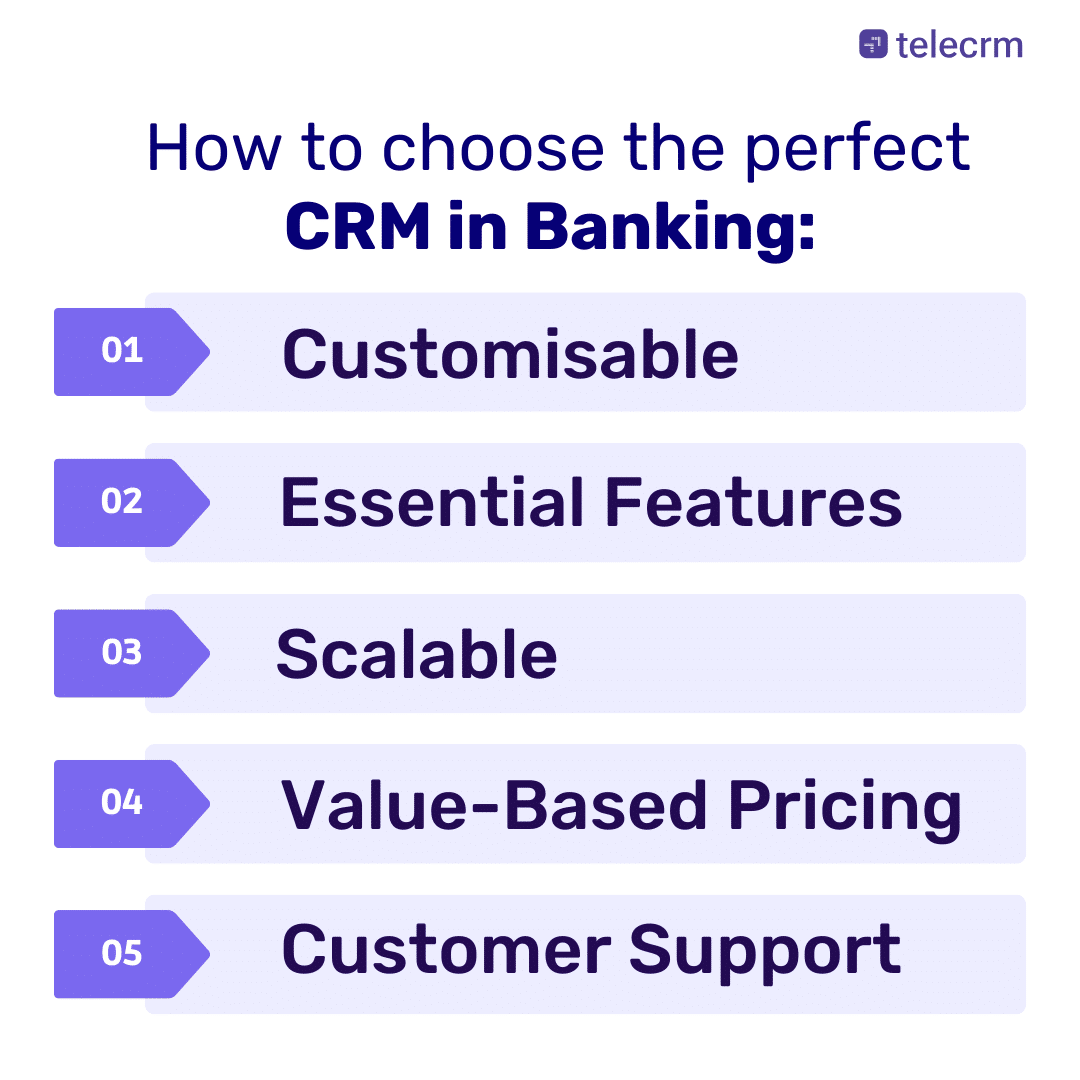

A CRM is like a one-way door decision for any enterprise, especially one as complex as a bank! So, here are a few questions that you need to ponder:

What problem are you trying to solve with it?

What kind of experience are you trying to create for your customers?

What features would you need for that?

The features can range from customer data management and workflow automation to advanced analytics. Thus, having a clear understanding of your needs will help you select the most suitable CRM for your bank.

Things such as flexible integration capabilities, robust security measures, a fully functional mobile app and customisable dashboards are a must. These features will enhance your bank’s efficiency and improve customer service experience.

Choose a CRM that can scale with your bank. As your customer base expands and your business needs evolve, the CRM should be able to adapt accordingly. This will prevent the need for frequent adjustments, ensuring long-term stability.

You want your CRM to be stable and secure with reliable updates and accessible support.

Start by asking:

Has the vendor worked with banks like yours or bigger for a similar use case in the past?

What was their experience like?

The price mentioned on the website versus what it’s actually going to cost you including implementation, training and maintenance is very different. Make sure that you know:

What you are going to pay in advance

The decision isn’t based on the cheapest or most expensive

You get very close to or exactly what you want within your budget

PRO TIP: CRMs are very modular in nature, so too much haggling upfront means you might end up paying hidden costs for modules down the line.

Attending a demo isn’t just about checking out the features. When you are looking for a CRM in banking, you are trying to address one or two key issues and the most critical aspect is whether it is powerful enough to solve those issues.

Before making a decision you need to know the following:

Does the CRM support all your key workflows, including the interdepartmental ones?

Does it have all the features that you need right now or in the near future?

Does it accommodate all your security and compliance needs?

What are the support modalities and channels?

Telecrm is an easy-to-use Indian CRM made for enterprises that cater primarily to Indian customers. It comes with the following features out of the box:

Telesales management

Leads and relationship management

WhatsApp and voice automation

Now let’s evaluate it based on the banking industry’s needs

✔️ Custom integration with existing banking solutions: We have an on-demand custom integration option available with our in-house integration team.

✅ Customer interaction tracking: Detailed history of every interaction in a single timeline.

✅ Telesales management: Telecrm started as a telesales management CRM and then evolved to cover more use cases.

✅ Automation: We have robust, highly usable DIY automation design tools available with expert assistance for automating complex workflows

✅ Central secure data management: We provide a separate, secure data server for our enterprise clients.

✅ Customisation: We have customisations built specifically for the Indian way of selling and relationship management. Case in point: our unique WhatsApp chat capture feature.

✅ Customer segmentation: Our customers have reported our filters and segmentation tool to be one of the simplest and easiest to use.

✅ Detailed relevant analytics: You can filter and segment any data you want and then create a detailed analytics report based on that data set.

✅ Scalability: The largest team that we serve is 10,000+ members strong

⭕ Credibility: We may not be the most reputed in this list, but we are successfully serving 3000+ Indian enterprises

✅ Budget friendliness: We are one of the most budget-friendly options loaded with features and customisation options.

All major modalities of CRM on a single platform

Simple, flat pricing with no hidden costs

Tailored for Indian teams’ workflows

Our biggest USP is that we offer consulting to make sure the CRM aligns with your bank’s workflow and that it’s set up in such a way that you are able to derive maximum value from it

Relatively new in the market compared to other examples

Customer engagement management is our primary focus, so we do not support team management, attendance, payroll, invoicing, etc at the moment

No native email integration support, you would have to integrate with 3rd party services!

Monday Sales CRM is a comprehensive, customisable customer relationship management platform known for its visual sales pipeline feature. So if sales pipeline management is one of your main use cases, Monday should be your go-to option.

Besides, the CRM in banking offered by Monday is part of a suite of offerings:

Monday Dev: Designed for software development teams

Monday Work OS: For teams to create workflow apps in a code-free environment

Monday Project Management: To plan and execute projects in real-time

✅ Integration with existing banking solutions: Supports a wide range of integrations with popular business software such as Slack, Gmail, HubSpot and Mailchimp — so probably not the best fit for Indian banks

✅ Customer interaction tracking: Has a visually pleasing dashboard that makes tracking interactions simple and fun

✅ Telesales management: Predominantly an email marketing platform but can be effective for telesales with features like call logging and telephony

✅ Automation: Monday follows the ‘when this happens, this is the action you need to take’ form of automation which makes it very easy to automate for even folks without any technical expertise

✅ Central secure data management: According to Monday, critical data is backed up every five minutes while non-critical data is backed up daily with other security measures in place

✅ Customisation: You can customise pipelines and dashboards through a simple drag-and-drop as per your needs

✅ Customer segmentation: Streamline customer targeting by segmenting customers based on any criteria such as purchase history, engagement levels, demographic information and more

✅ Detailed relevant analytics: With Monday, you can create sales forecasting based on past trends, customise dashboards and get detailed reports to track sales performance

✅ Scalability: Has features that allow 1TB file storage and 250K actionable automation in its enterprise plan. So even if the scale of your operation, Monday is designed to adjust.

✅ Credibility: Trusted by over 100,000 organisations worldwide, including high-profile companies like Adobe, Unilever, Universal Music Group, etc.

⭕ Budget friendliness: The ‘Standard’ plan is $12 per user and the ‘Pro’ plan costs $19 which is extremely affordable given all the features unless you have a large team.

Intuitive and visually appealing Kanban boards that give you a comprehensive overview of your sales process and help you pinpoint the scope for improvement

A high level of customisation ensures the CRM adapts to your bank, not the other way round

Though simple, your team will require extensive training to get used to it

Immediate customer support is not available through meetings or calls

An industry-specific software by Salesforce designed primarily for banking, insurance and asset management institutions. It thrives on its ability to automate tasks including, but not limited to:

Updating customer info automatically

Issuing debit and credit cards

Customer interaction on due payments

✔️ Custom integration with existing banking solutions: Leverages Salesforce’s own suite of applications like Sales Cloud and Service Cloud as well as MuleSoft for integration with third-party applications (very Salesforce-centric).

✅ Customer interaction tracking: One of the best CRM in banking when it comes to providing a complete history of every interaction, including in-person meetings, phone calls and virtual meetings conducted via video conferencing tools.

✔️ Telesales management: With its AI tool, Einstein, you can automatically record details of each call, such as duration, participants and key points discussed. You can even integrate with their telephony solution to make calls but it’s not a calling software.

✅ Automation: Leverages Einstein AI for predictive analytics, AI-powered chatbots for real-time customer service and the Process Builder tool and MuleSoft integration for workflow automation.

✅ Central secure data management: The platform complies with industry standards like HIPAA, making it a reliable choice for managing sensitive financial information.

✔️ Customisation: Already designed for finance but still extremely customisable (to the point that it might confuse you).

✅ Customer segmentation: You can segment customers not just based on historical data like purchase history and demographics, but also on predictive behaviours and future needs and boost customer retention and customer satisfaction.

✅ Detailed relevant analytics: Provides predictive insights and personalised recommendations based on your data. You can even generate reports to track sales performance and better understand customer behaviour.

✅ Scalability: Infosys and Wipro use Salesforce Financial Services Cloud, so yes, it will adjust to your growing needs

✅Credibility: Trusted by over 150,000 companies worldwide and serves millions of users daily

❌ Budget friendliness: Not cost-effective — the plan sands $300/user so unless you have very complex workflows and a small team, it’s not the right fit

Designed specifically for financial institutions with account and contact management features that make segmentation easy for banks

You can get access to well-documented help guides and videos on YouTube as well as their website to help you guide throughout the implementation process

Not the most user-friendly CRM in the market — requires extensive training and adjustment period

Not very budget-friendly when compared to other almost equally capable software, which retail for a lesser price

The term ‘Dynamic’ here is not for show. It has a suite of offerings concerning finance, sales, customer service, supply chain management and much more! Some relevant options for banks are:

Microsoft Dynamics 365 Sales (Best for banks): To understand, segment and target your prospects and customers regarding loans, issue of debit and credit cards etc.

Microsoft Dynamics 365 Customer Service: Designed primarily for keen insights on existing customers

Microsoft Dynamics 365 Finance: Use this tool only if your bank deals with forecasting the probability of loan payments and tracking finances

✅ Custom integration with existing banking solutions: Integrates with Microsoft’s suite of applications like Microsoft 365, Azure and other third-party platforms through Microsoft Dynamic 365 APIs

✅ Customer interaction tracking: You can track engagement throughout the customer journey and optimise the software to process more loans and get a better understanding of your customers

✅ Telesales management: Each call made through the CRM is automatically logged, capturing essential details such as call time, duration, outcome and any follow-up actions required

✅Automation: Interact with your customers on autopilot through emails and send updates about due payment, new offers, EMI processes and much more!

✅ Central secure data management: Ensures data security and compliance with industry standards, including GDPR and HIPAA

✅ Customisation: You can tailor dashboards, workflows and reports according to how you do business

✅ Customer segmentation: With Microsoft’s Segment Builder feature, users can define multiple rules and conditions to filter and group customers based on various criteria

✅ Detailed relevant analytics: Imagine an AI assistant within a CRM that tells you how many loan payments are due this month with a single search, or a system that tells you the number of credit cards that need to be issued to complete the target — that’s exactly what Microsoft Dynamics can do

✅Scalable: Is scalable but then you’ll have to integrate with other Microsoft offerings as well if you want to onboard all your teams

✅Credibility: It’s Microsoft so it’s as credible as it can get

❌Budget friendliness: Affordable if you just go for one product (Microsoft Dynamics 365 Sales) but costlier than Salesforce if you go for more than one offering

It is suitable for banks of all sizes in the banking industry, and has a great adoption rate along with a reasonable learning curve

Again, since it’s a popular platform, the company provides ample resources including articles, video tutorials and email support for you to set up your workspace

Different products for sales and support make it almost a compulsion to purchase both platforms

The base plan is perfect for your bank, with one exception: if you’re not high on AI and Copilot because it is only available from the ‘Pro’ version

The only reason why Zoho CRM software is at the bottom of the list is because it is too comprehensive for banks. Having said that, it is hands down one of the most dynamic CRMs in the market.

The primary use case of Zoho’s CRM in banking is concerned with its automation capability; it helps you automate the complete loan process — from loan form submission to loan approvals to tracking and processing payments.

✅ Custom integration with existing banking solutions: With Zoho, you can use custom API to integrate with your applications and get access to a wide range of integrations through the Zoho marketplace.

✅Customer interaction tracking: Get a 360° view of all customer interactions in one dashboard.

✅Telesales management: Normally in India, you either call your leads/customers or send them an SMS, a WhatsApp message or an email. With Zoho you can do everything from one dashboard.

✅Automation: Send reminders about pending payments and procedures to your existing customers and also promote additional services through email automation.

✅ Central secure data management: Zoho safeguards your data with features like encryption, access controls and by complying with industry regulations.

✅ Customisability: Design the dashboard according as per your needs.

✅ Customer segmentation: You can create fields for specific data points such as account type, transaction frequency, loan amount and more to segment your leads on any criteria.

✅ Detailed relevant analytics: Zoho’s AI Zia offers detailed insights on metrics such as team performance, credit cards sold, debit cards issued, etc., for you to make informed decisions.

✅ Scalable: Zoho is a global MNC with over 50 software products to help businesses scale and improve processes

✅ Credibility: Over 250,000 businesses across 180 countries rely on Zoho CRM to manage their sales, marketing and customer support activities.

✅ Budget friendliness: Zoho offers an affordable CRM solution relative to other software giants such as Microsoft Dynamics and Salesforce

Zoho has a free forever version which will help you figure out if it’s the right fit for your business needs

You can easily collaborate with your team right from the dashboard by creating groups and tagging concerned team members

Since the CRM is feature-rich, some users may find it complicated to use

There have also been occasional issues with third-party integrations and customer support responsiveness

In this article, we have covered:

What role does a CRM in banking play and why do you need one?

Benefits of a banking CRM

How to choose the best CRM for your needs

Top CRMs for banks and other financial services institutions. (You can bookmark this article and use it when you are evaluating and comparing CRMs.)

In case you’re interested, book a meeting with a representative from Telecrm to help you understand the product better.

© Copyright 2025 Telecrm.in - All Rights Reserved • Privacy Policy • T&C

© Copyright 2025 Telecrm.in - All Rights Reserved • Privacy Policy • T&C