You’ve got all this information — numbers, charts and reports — but making sense of it is a different ball game altogether. Enter sales analytics — a set of processes that helps break down the massive piles of data into clear, actionable insights. This means you can stop playing the guessing game and start making informed decisions, ultimately, improving your sales numbers by a big margin.

Here’s how diving into sales analytics can benefit your sales strategy:

Spot trends: Figure out which strategies work for your business and which don’t. This helps you repeat successful actions and cut out waste.

Understand customer behaviour: Learn what works for your customer and what doesn’t. This knowledge lets you tailor your approach to meet their needs and capture more sales.

Boost sales efficiency: By focusing on the right areas, your agents can use their time more effectively, increasing overall sales without putting in extra hours of laborious work

Turning your raw data into a strategic asset, sales analytics not only clarifies your next steps but also boosts your confidence in making those decisions.

In this blog we’ll be discussing the benefits of sales analytics, important metrics you ought to know and the best practices to derive maximum benefit from your data.

Sales analytics is the process of collecting, analysing and interpreting various data points to better understand your sales activities. It allows you to take stock of your sales processes, helping you identify the fastest and most efficient routes to achieve your goals.

At its core, sales analytics involves:

Data collection: Gathering data from all sales activities, including customer interactions, sales transactions and marketing campaigns

Data analysis: Using statistical tools and models to sift through collected data, identifying patterns and trends that are not immediately obvious

Decision-making: Applying insights gained from the data analysis to make strategic decisions that can lead to increased sales efficiency and effectiveness

This strategic approach allows businesses to move from reactive selling to proactive sales management, where decisions are not based on hunches but on solid data insights. Whether it’s improving lead conversion rates, adjusting sales tactics or enhancing customer relationships, sales analytics lays the foundation for a winning sales strategy.

Switching to sales analytics can really change the game for your team, turning guesswork into a more precise science. Here’s how:

Make smarter decisions faster: Sales analytics gives you real-time updates and clear insights so you can make quick decisions that keep you ahead of the competition.

Get more done with less: It helps you determine which sales tactics and channels work. This means your team can focus its efforts where it counts, without wasting time and resources on activities that don’t lead to sales.

Predict your sales more accurately: Sales analytics uses past sales data to give you a good guess of future trends, helping you be better prepared for any lean times.

Keep your customers happy: By understanding what your customers want and how they behave, you can tailor your approach to meet their needs better. Happy customers are likely to stick around longer and become brand loyalists.

Align your marketing and sales teams: When your marketing and sales teams use the same data to make decisions, they work better together helping ensure that their combined efforts boost the overall results.

These benefits collectively lead to more robust, agile sales operations that not only meet their targets more consistently but also grow in capability and efficiency over time. In the next section, we’ll explore the key metrics that can help you reap these benefits in 2024 and beyond.

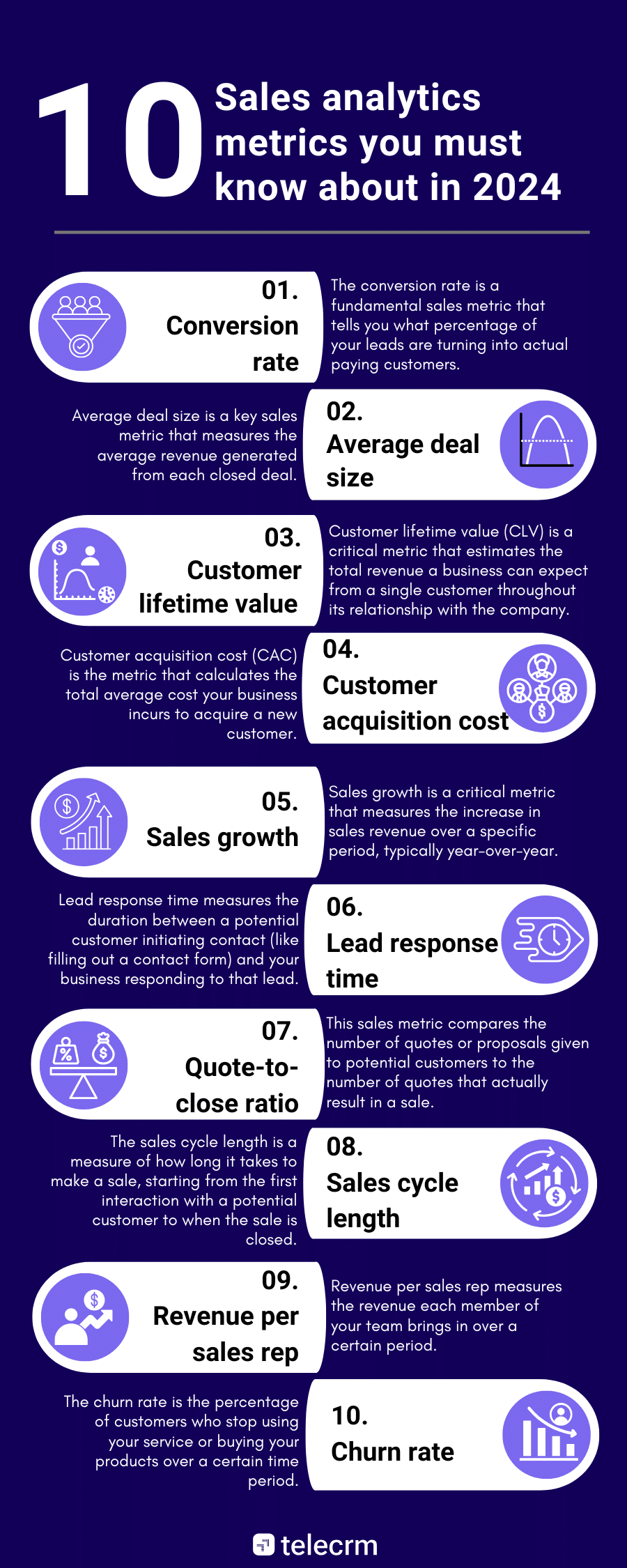

The conversion rate is a fundamental sales metric that tells you what percentage of your leads are turning into actual paying customers. For example, if 100 people visit your store and 10 of them make a purchase, your conversion rate is 10%.

Conversion Rate = (Number of Sales / Number of Leads) * 100

The conversion rate is crucial because it directly affects your revenue.A higher conversion rate means more customers, which can significantly boost your profitability without increasing your marketing spend. It also helps you understand the effectiveness of your sales funnel and strategies.

Your conversion rate can be improved in several ways:

Enhance lead quality: Start by ensuring that the leads entering your sales funnel are well-qualified. This might mean refining your marketing campaigns to target a more specific audience that is likely to be interested in your products or services.

Optimise your current sales processes: Look at each step of your sales process to find bottlenecks or points where prospects drop out. Simplifying the purchasing process or providing more information and support at critical decision points can help.

Train your sales team: Regular training and upskilling can improve your team’s closing techniques. Role-playing scenarios that cover common customer objections or hesitations can prepare them to handle real-world situations more effectively.

Personalise your approach: Tailoring the sales experience to meet the specific needs and preferences of each lead can make a big difference. This might involve personalised emails, custom demos or targeted offers based on the lead’s previous interactions with your company.

Average deal size is a key sales metric that measures the average revenue generated from each closed deal. For instance, if you close 50 deals that cumulatively generate ₹50,000, your average deal size would be ₹1,000.

Average deal size = Total Revenue / Number of Deals

The average deal size helps you gauge the value of your sales efforts. A larger average deal size indicates more lucrative deals and a focus on higher-value clients, which can lead to increased revenue with fewer transactions. It also offers insights into buying trends and customer preferences, informing product or service adjustments.

Here are a few strategic approaches to increasing your average deal size:

Upsell and cross-sell: Educate your customers about the full range of your products or services. Implementing effective upselling and cross-selling strategies during the sales process can encourage customers to purchase more expensive items or add-ons.

Target higher-value clients: Adjust your sales and marketing strategies to attract clients who have the potential to make larger purchases. This might involve shifting your focus to a different demographic or market segment that typically seeks premium options.

Bundle products or services: Create packages or bundles that combine multiple products or services at a slightly reduced price compared to buying items individually. This not only increases the perceived value but also encourages larger purchases.

Refine pricing strategies: Reassess your pricing structure to ensure it matches the value provided, especially if your offerings have evolved. Sometimes, raising prices can positively impact the perception of your product’s value, leading to higher average deal sizes.

Customer lifetime value (CLV) is a critical metric that estimates the total revenue a business can expect from a single customer throughout its relationship with the company. For instance, if a customer spends an average of ₹500 annually and usually sticks around for 10 years, their CLV would be ₹5,000.

Customer lifetime value (CLV) = Average Order Value * Number of Repeat Sales * Average Retention Time

Understanding CLV is essential because it helps you determine the financial worth of your customers and guides decisions related to marketing and sales spending. A higher CLV means that customers are not only spending more but are also staying loyal over time. This insight allows you to allocate resources more effectively and focus on nurturing long-term customer relationships, which is often more profitable than constantly pursuing new customers.

Boosting your CLV involves several strategies:

Enhance customer satisfaction: Deliver exceptional customer service and high-quality products that exceed expectations. Satisfied customers are more likely to return and make additional purchases.

Implement loyalty programs: Introduce rewards and loyalty programs that encourage repeat business. This could be discounts, special offers or early access to new products, which enhance customer retention and increase the frequency of purchases.

Personalise customer interactions: Use data analytics to tailor your marketing and sales efforts to the specific needs and preferences of individual customers. Personalisation enhances the customer experience and can lead to increased spending.

Focus on high-value customers: Identify which customers have the highest CLV and create strategies specifically targeted at retaining these valuable clients. This might involve exclusive services or premium product offerings.

Customer acquisition cost (CAC) is the metric that calculates the total average cost your business incurs to acquire a new customer. This includes all marketing and sales expenses divided by the number of customers acquired over a specific period. For example, if you spend ₹10,000 on marketing in a month and acquire 100 new customers, your CAC is ₹100 per customer.

CusCustomer acquisition cost (CAC) = Total Marketing Expenses / Number of New Customers Acquired

CAC is a vital measure because it tells you how much you are spending to attract each new customer. Understanding this helps you manage your marketing budget more effectively, ensuring efficient spend management and avoiding overspending to acquire customers whose CLV does not justify the initial expenses. Keeping CAC in check is crucial for maintaining healthy profit margins and achieving sustainable growth.

Reducing your CAC requires a multifaceted approach:

Streamline marketing efforts: Focus on channels and campaigns that yield the highest return on investment. Use data analytics to track the performance of different channels and shift resources to the most effective ones.

Improve conversion rates: Enhance the effectiveness of your sales funnel. Small improvements at each stage of the funnel can reduce the overall cost per acquisition by increasing the number of customers who complete a purchase.

Leverage organic marketing strategies: Invest in SEO, content marketing and social media engagement to build organic traffic. These strategies often have lower costs compared to paid advertising and can reduce CAC over time.

Refine targeting: Use customer data to refine your target demographics. Better targeting can lead to higher conversion rates as your marketing efforts are focused on individuals more likely to be interested in your product or service.

Sales growth is a critical metric that measures the increase in sales revenue over a specific period, typically year-over-year. For instance, if your company earned ₹200,000 in sales last year and ₹240,000 this year, your sales growth rate would be 20%.

Sales Growth = ((Current Period Sales – Previous Period Sales) / Previous Period Sales) * 100

Sales growth is a key indicator of your business’s health and its ability to grow. It reflects not just the effectiveness of your sales strategies but also your company’s capacity to attract and retain customers. Sustained sales growth suggests that your business is thriving and managing to increase its market share, whereas stagnation or decline could signal problems that need addressing.

There are several strategies to drive sales growth:

Expand your market reach: Explore new markets by targeting different geographies or demographics. Diversifying your customer base can lead to an increase in sales volume.

Introduce new products or services: Innovate by adding new offerings or improving existing ones. This can attract new customers and also result in increased spending from current ones.

Enhance customer relationships: Build stronger relationships with existing customers through improved customer service, loyalty programs and proactive engagement. Happy customers are more likely to make repeat purchases and recommend your business to others.

Optimise pricing strategies: Review and adjust your pricing to ensure it aligns with what your market can bear. Competitive pricing can help attract new customers and retain existing ones, driving up sales.

Lead response time measures the duration between a potential customer initiating contact (like filling out a contact form) and your business responding to that lead. For example, if a customer sends an inquiry at noon and receives a response by 1 pm, the lead response time is one hour.

Lead Response Time = Time of Response – Time of Inquiry

The speed of your response can significantly impact your ability to convert inquiries into sales. Studies have shown that leads are most likely to convert shortly after they make initial contact. A swift response not only meets customer expectations for quick service but also capitalises on their initial interest, which can diminish over time. A slow response, on the other hand, can lead to a poor first impression and potentially result in the loss of a customer.

To reduce your lead response time, consider these strategies:

Automate responses: Sales automation softwares provide an immediate acknowledgement of customer inquiries. This can include auto-responders in emails or chatbots on your website, ensuring that customers feel heard right away.

Streamline communication channels: Use a CRM software to manage and monitor all communications, ensuring all customer inquiries are funnelled to a central point where they can be quickly addressed.

Train your team for efficiency: Equip your sales team with the tools and training they need to respond quickly. This includes defining clear procedures for handling inquiries and ensuring they have access to the necessary information to provide prompt and accurate responses.

Monitor response times and set goals: Regularly review how long it takes your team to respond to leads and set realistic improvement goals. Reward teams or individuals who meet or exceed these targets to encourage promptness.

The quote-to-close ratio is a sales metric that compares the number of quotes or proposals given to potential customers to the number of these that actually result in a sale. For instance, if your team sends out 100 quotes in a month and closes 25 sales, your quote-to-close ratio is 25%.

Quote to Close Ratio = (Number of Sales / Number of Quotes Given) * 100

This ratio is crucial for understanding the effectiveness of your sales proposals and the efficiency of your team. A higher ratio indicates that your team is effective at converting potential sales into actual revenue, while a lower ratio might suggest that there are issues in the sales process or the quality of the proposals themselves. Analysing this metric helps identify areas where sales efforts can be optimised, ensuring that your team is not wasting time on leads that are unlikely to convert.

Enhancing your quote-to-close ratio involves several targeted strategies:

Refine your qualification process: Ensure that your sales team is focusing their efforts on high-quality leads who are more likely to make a purchase. This involves careful lead screening and qualification at the beginning of the sales process.

Improve proposal quality: Make sure that your proposals are clear, compelling and tailored to meet the specific needs of each potential customer. Include detailed solutions that address their unique challenges and highlight the value your product or service offers. Using SAP CPQ can streamline this process by quickly generating customized quotes that match customer needs.

Train your sales team: Regular training programs can equip your sales reps with the necessary skills (negotiation tactics, understanding customer needs intuitively and effective communication) to surpass their sales quota.

Follow up effectively: Develop a systematic follow-up process. Sometimes, deals don’t come to fruition simply because there wasn’t adequate follow-up after a proposal was sent. Scheduling timely follow-ups can keep your proposal top of mind for potential clients.

The sales cycle length is a measure of how long it takes to make a sale, starting from the first interaction with a potential customer to when the sale is closed. For example, if a customer first inquires about your product on the 1st of January and the sale is finalised on the 30th of January, your sales cycle length is 30 days.

Sales Cycle Length = Date of Sale Close – Date of Initial Contact

The length of the sales cycle is a critical indicator of sales efficiency and customer decision-making processes. A shorter sales cycle often leads to increased revenue and a faster return on investment because you can turn leads into paying customers more quickly. Conversely, a lengthy sales cycle can tie up resources and delay revenue, impacting your business’s cash flow and growth potential.

There are several effective strategies to reduce the sales cycle length:

Streamline the sales process: Eliminate unnecessary steps by automating parts of the sales process, such as using online forms for initial inquiries or digital signatures for contract approvals.

Enhance team training and tools: Equip your team with the training and tools they need to move deals forward efficiently. This includes training on handling objections, negotiation skills, and providing them with the technology to quickly access and share information with prospects.

Improve lead qualification: Focus on better lead qualification to ensure that your sales team spends time on leads with a higher likelihood of closing. This can involve more detailed initial assessments or using scoring systems to prioritise leads based on their potential.

Communicate effectively: Maintain clear and consistent communication with potential customers throughout the sales process. This helps keep the deal moving by ensuring that any questions or concerns are addressed promptly, thereby preventing delays.

Revenue per sales rep measures the revenue each member of your team brings in over a certain period. For example, if one of your salespeople secures ₹50,000 in sales during a quarter, that’s their contribution towards the overall revenue generated by the team.

Revenue per Sales Rep = Total Sales Revenue / Number of Sales Reps

This metric helps you see how well each salesperson is doing. It’s great for spotting your top performers and figuring out who might need a bit more help or training. Keeping an eye on this can also guide where you might need to shift resources to make the team even stronger.

Here are some straightforward ways to help your sales team do even better:

Provide better training: Keep your team’s skills sharp with ongoing training. This can cover everything from effective selling techniques to hands-on product training.

Get the right tools: Make sure your team has the best tools for the job. This might mean up-to-date CRM software, quick access to sales data or apps that help them sell on the move.

Set clear targets and rewards: Set clear sales goals and offer incentives that get everyone excited. Make sure these goals are fair and reachable, and that the rewards are genuinely appealing.

Create a supportive atmosphere: Encourage a team environment where everyone can share tips and support each other. A happy sales team is usually a more successful one.

The churn rate is the percentage of customers who stop using your service or buying your products over a certain time period. For instance, if you start the year with 100 customers and 10 stop buying by the end of the year, your churn rate is 10%.

Churn Rate = (Number of Customers Lost / Number of Customers at Start) * 100

Understanding your churn rate is crucial because it shows how well you’re able to hold on to your existing customers. A high churn rate can be a warning sign that something’s not working for your customers, whether it’s your product, customer service or something else. A low churn rate means more customers stick around, which is great for stable revenue and growth.

Here are some practical steps to keep your customers happy and reduce churn:

Listen to customer feedback: Regularly ask your customers for feedback and act on it. This shows you value their opinion and are committed to making improvements.

Enhance customer service: Make sure your customer service is top-notch. Quick, helpful responses to queries or problems can make a big difference in whether customers feel valued and decide to continue doing business with you.

Offer loyalty rewards: Create a loyalty program that rewards customers for staying with you. This could be discounts, special offers or early access to new products.

Keep improving your product: Keep iterating your product based on customer feedback and market trends. Keeping things fresh and relevant helps maintain customer interest and satisfaction.

When concluding your search for a sales analytics tool, it’s crucial to ensure that the tool you choose can robustly support your business goals with detailed insights and actionable data. Consider tools like Telecrm (India’s best sales CRM) that offer comprehensive analytics capabilities, including:

Customisable reporting: Tailor your sales reports to focus on the metrics that matter most to your business for precise analysis. Telecrm allows generating reports for different durations (daily, weekly, monthly) for different purposes (calls, lead generated, etc.) all with extensive customisation options to create reports that will directly help in your future sales strategies and outcomes.

Real-time data: Access up-to-date information that can help you make swift decisions in dynamic market conditions. Telecrm offers live data tracking, ensuring you have the most current information at your fingertips.

Integration capabilities: Ensure the tool integrates seamlessly with other platforms your business uses, enhancing overall efficiency. Telecrm’s integration features help connect smoothly with various other tools.

User-friendly interface: Opt for tools that are easy to use and require minimal training, so your team can leverage them effectively without technical hurdles. Telecrm is designed with user experience in mind, making it accessible for all skill levels.

With these features, your team will be equipped with all the necessary resources to refine their sales strategies, enhance performance and drive sustainable growth.

Ready to see how Telecrm can fit into your business ecosystem? Schedule a demo today to experience its full potential.

© Copyright 2025 Telecrm.in - All Rights Reserved • Privacy Policy • T&C

© Copyright 2025 Telecrm.in - All Rights Reserved • Privacy Policy • T&C